Hello, friends! Today we’ll talk about the Adani Power Share Price Target 2025. We’ll find out where the performance of this fast-growing company in the power sector, which is part of the Adani Group, is likely to go in the coming years. In the power industry, Adani’s power has been overgrowing over the past few years.

Today, we will not only look at Adani Power’s business in detail, but we will also look at the company’s future business opportunities. This will give us an idea of how much Adani Power Share Price Target can show in the coming years. Let us analyze this in detail-

About Adani Power Company

Adani Power is one of the largest companies in India that makes electricity. It is a part of the Adani Group, one of India’s largest business groups. The company has a total installed capacity of 12,450 MW, spread across six thermal power plants and one solar power plant. Both the National Stock Exchange and the Bombay Stock Exchange list the shares of Adani Power.

Adani’s energy sales have expanded in tandem with the rise in energy demand; according to the business’s most recent quarterly statistics, the company has performed admirably. As the need for energy grows in the future, the corporation will be perceived to be highly effective.

| Name | Adani Power |

| Founded | 22 August 1996 |

| Subsidiaries | Raipur Energen Limited |

| Headquarters | Ahmedabad |

| Stock price | ADANIPOWER (NSE) ₹140.80 |

| Website | www.adanipower.com |

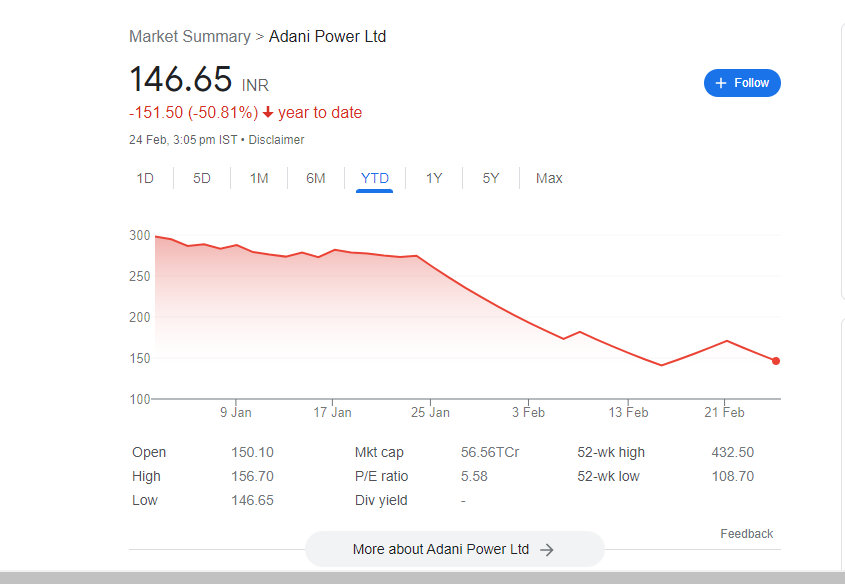

Adani Power Share Price Target 2025

Adani Power sold 59.3 billion units of electricity from all plants during FY 2020-21, compared to 64 billion units in FY 2019-20, with the Plant Load Factor (PLF) declining from 66.6% the previous year to 58.9% in FY 2020-21.

With rising living standards, increased electrical and electronic device penetration even in rural regions, and the government’s focus on expanding the manufacturing sector’s share of GDP development, per capita consumption and total power demand are expected to rise dramatically. The price prediction for Adani Power Share Price Target 2025 is Rs 590, based on the future growth potential for power sector firms.

Adani Power Share Price Target 2023-2030

| Year | Adani Power Share Price Target |

| 2023 | Rs 380 |

| 2024 | Rs 455 |

| 2025 | Rs 590 |

| 2030 | Rs 1,760 |

Future Of Adani Power Share

Adani Power is the Adani Group’s flagship firm, India’s biggest private-sector power provider. It has built itself as an industry leader by investing in power production, transmission, and distribution to provide inexpensive and dependable energy to millions of Indians. Their stock is projected to profit from an increase in power usage throughout the nation, thanks to an ambitious ambition to create 45GW of renewable energy by 2025.

Adani Power, one of India’s largest power providers, has recently seen its share price skyrocket. This is due to the government’s new plan to assist businesses supplying renewable energy solutions. Adani has been significantly investing in new projects to capitalize on this strategy, and its long-term advantages are projected to grow the firm even more in the coming future.

Risk Of Adani Power Share

Investing in Adani Power shares may result in increasing debt. The corporation is taking out large loans to support its different initiatives and expansions, expanding its debt load. This might impact Adani Power’s profitability and share price in the future.

Adani Electricity is a significant provider of India’s power industry. However, Adani Power faces a few hazards in the company. One is the massive amount of cash necessary for new projects and other critical advancements. If Adani Power fails to invest correctly, its share price and the whole company might suffer greatly.

How To Buy Adani Power Share?

To buy Adani Power shares, you’ll need to open a trading and Demat account with an Indian stock market-accessible broker. Here are the main steps you should take:

- Choose a broker: Do some research and choose a broker who can help you trade on the Indian stock market. You can choose between a traditional and an online broker, depending on your needs and preferences.

- Open a trading and Demat account: To open a trading and Demat account, you will need to give some personal and financial information. The trading account will let you buy and sell shares, while the Demat account will hold your shares.

- Fund your account: Once it is set up, you will need to add money to it to buy Adani Power shares. You can send money from your bank account online, using a debit card, or using another payment method your broker accepts.

- Put in order: Once you’ve put money into your account, you can put in to buy Adani Power shares. You will need to put in the share symbol the number of shares you want to purchase and the price you are willing to pay. The order will be carried out for you by your broker.

- Keep an eye on your investment: Once you’ve bought Adani Power shares, you should regularly keep an eye on your investment to see how it’s doing and decide when to buy or sell.

FAQs Regarding Adani Power Share

Ans: Right now, the firm is performing well in its area and profiting.

Ans: At the time, the firm is doing well in its industry. If the firm continues to produce positive results, we may conclude that Adani Power is a long-term investment.

Ans: The target price for the Adani Power Share Price in 2025 is Rs. 590.

Ans: The corporation is in debt for a total of 15,299.21 Cr.

Ans: Adani Power is owned by the Adani Group, which is headed by Gautam Adani.

Adani Power Share Target Price 2025

Final Words!

Adani Power shares have benefited investors over the last five years. Despite this, the company’s fundamentals are weak. However, the power and transmission sectors provide excellent development potential, and Adani Power’s management is charged with capitalizing on these opportunities in the future.

In this article, we discussed Adani Power Share Price Target 2025, and if you find it beneficial, please share it with your friends on social networking platforms!

Thanks for Reading!